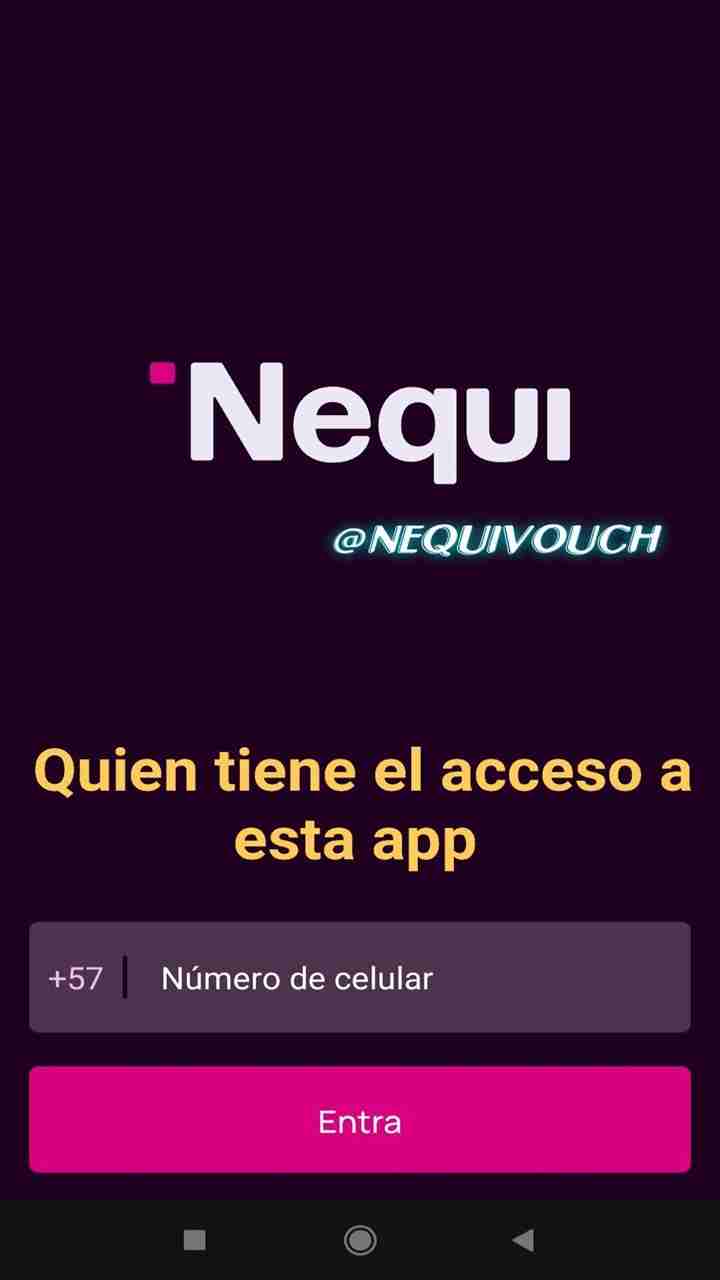

NequiDz V2 APK

By: Nequidz Dev

Rating: 4.6+ Downloads: 620+ Size: 6.9 MB Updated: April 22, 2025.

NequiDz V2 APK is a cutting-edge financial app designed to help Colombians manage their money directly from their smartphones. As a digital wallet, it offers many features to simplify financial activities, such as organizing money into multiple categories, making instant transfers, and setting up automatic bill payments.

The user interface is straightforward, colorful, and intuitive, ensuring a smooth experience for new and experienced users. If you’re looking for an app that makes your financial transactions straightforward and secure, Nequi Dz V2 for Android is a must-have. With features like virtual and physical Mastercards, budgeting tools, and instant access to small loans, it aims to make financial management easier and more efficient.

What is NequiDz V2 APK?

NequiDz V2 APK is a mobile loan application platform that allows users in the Philippines to apply for cash loans and receive them directly into their bank account or e-wallet. This app is quick and easy to use and is aimed at people who don’t have access to traditional banking services or who need immediate financial assistance.

Its generosity and commitment to straightforward loan terms differentiate it from other online lenders. Using various convenient tools, users can instantly determine their creditworthiness, calculate interest, and make repayments. The simple application process requires only a valid ID, some basic personal information, and a mobile device with an internet connection.

The main complaints about online loan apps that Nequidz addresses include aggressive lending strategies, hidden fees, and privacy issues. More explicit terminology, better encryption, and more attentive support staff are some of the measures the latest version uses to regain user trust. It offers new and loyal customers a safer and more discreet lending experience.

What are the Features of NequiDz V2 APK?

NequiDz V2 APK Mod has powerful tools that give users more control and flexibility in managing their money. Other notable features include:

Pockets: Organize your money into different categories, such as rent, savings, or travel. This helps you manage your budget more effectively.

Automatic Payments: Easily schedule bill or subscription payments to avoid late fees.

Instant Transfers: Send and receive money to other Nequi users and linked bank accounts in real time.

Virtual and physical cards: Shop securely online or in physical stores with your Neki Mastercard.

Credit and loan options: Eligible users can take out small loans through the app without any paperwork.

Benefits of using NequiDz V2 APK:

Although unofficial, Nequidz V2 APK for Android offers several practical advantages:

- Personalization: Users can adapt invoices to different situations.

- Time-saving: Useful for quickly creating financial visualizations without writing code.

- Performance display: Ideal for training or financial presentations.

- Portability: It works well on most Android phones, often even without internet access.

These advantages make it a valuable tool in some situations, especially for those working in the virtuous ecosystem.

User interface (UI) and user experience:

The NequiDz V2 APK’s design is attractive and recognizable. Once you log in, the interface looks modern, colorful, and user-friendly. Important tabs such as “Money,” “Pocket,” and “Loan” are easily accessible, making navigation simple even for new users.

The user experience is focused on simplicity. Each feature is equipped with clear instructions, and the app is available in Spanish and English to appeal to a broad audience. The registration process is simple: You can create an account in just a few steps.

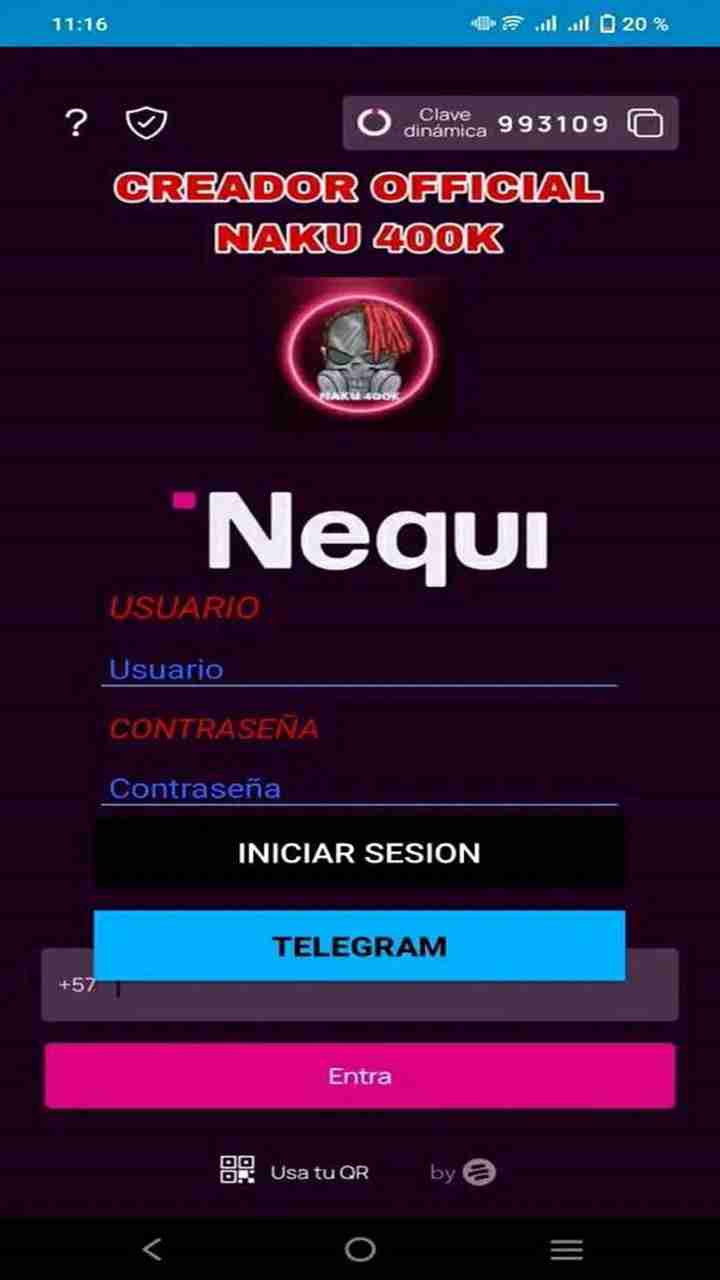

Possible Use Cases (Ethical and Other):

Using NequiDz V2 Mod APK may involve several ethical aspects, and it is essential to understand them before using the app.

1. UI/UX Testing: Developers building fintech apps often need to simulate financial data for operational reasons. Apps like NequiDzV2 can help visualize what a digital wallet interface with transaction data will look like.

2. Education and Financial Literacy: Training or classrooms often require simulated data to teach participants how to read or interpret financial reports. It can serve as an essential tool for this.

3. Entertainment and Fun: It can be used for entertainment or light pranks as a fake call app or prank banking app. However, users openly believe this app is fake.

User Interface and User Experience Analysis:

NequiDz V2 offers a minimal and intuitive user interface. Here’s what’s special:

Clear Layout: The design mimics the familiar structure of digital wallets, making it easy to navigate for users of apps like Nequi.

Fast Interaction: The lightweight architecture ensures fast loading times and smooth menu interactions.

Input Accuracy: The input fields are labelled and intuitive, reducing the risk of errors when entering transaction details.

However, since it is a third-party app, it does not offer a good and robust backend like officially supported financial instruments. Furthermore, support and updates are limited, which may affect long-term use.

Discover the User Interface: Important Features and Tips for Best Use:

You will see a clean and user-friendly interface when you launch the NequiDz V2 APK app. Here are some highlights:

Smart Dashboard: See all your balances, recent transactions, and spending trends at a glance.

Goal-Based Savings: Set multiple savings goals (for travel, education, or emergencies) and track your progress in real time.

Real-time Notifications: Receive instant notifications for every transaction, improving control and transparency.

Bill Sharing: Easily share your expenses with friends and family without complicated calculations or tracking.

Integration with other services: To simplify monthly payments, connect your NequiDz account to services like utilities or streaming platforms.

Similar Apps to NequiDz V2 APK:

NequiDz V2 APK offers a unique feature, but there are other tools with similar features:

PixGerador (Brazil): Allows users to create fake Pix receipts, which are very popular in Brazilian digital banking.

Fake Receipt Maker (General Purpose) – Provides customizable receipt templates for various types of transactions.

MockPay: A tool used for demonstration purposes in fintech education that provides a mock wallet interface for simulation.

These apps, like NequiDz V2, are often used for training, testing, and interface preview purposes, not for actual use.

Why choose NequiDz V2 APK?

NequiDz V2 APK is not just an app but a toolbox for Android users. Here are some reasons why users around the world use this app:

- Absolute ease of use: No need to install separate apps for performance, customisation or privacy.

- Lightweight: Despite its many functions, it requires little storage space.

- Regular updates: The app has new features, improvements, and bug fixes.

- No rooting required – anyone with a standard Android phone can use this app.

- Safe and stable: Scanned for malware and optimised for performance to keep your phone running smoothly.

How to Download and install NequiDz V2 APK?

NequiDz V2 APK Download is very easy, but you must install it manually since it is not available on the Google Play Store. Here’s how:

Step 1: Enable Unknown Sources:

- Go to your Android phone’s settings.

- Tap on “Security” or “Privacy”.

- Enable installation from unknown sources.

Step 2: Download the APK file:

- Visit a trusted APK website or official source that hosts the APK.

- Download the latest version of the APK file.

Step 3: Install the app:

- Open the file manager on your phone.

- Find the downloaded APK file (usually in the Downloads folder).

- Tap on the file and select “Install”.

- Please wait a few moments until the app is installed.

Step 4: Launch the app:

- After installation, tap Open or find the app icon in the app drawer. Discover all the features of the APK.

FAQs:

Can I use NequiDz V2 APK outside of Colombia?

Currently, it is only available to Colombian users. Although the app is available for download, some services, especially those related to local remittances and payments, may be limited to Colombian users.

How can I manage my money on the NequiDz V2 APK?

Its ” Pockets ” feature allows you to divide your money into different categories, such as savings, bills, or travel expenses. This helps you manage your money efficiently and ensures that you always know where it is going.

Can I send money to someone who does not use the NequiDz V2 APK?

You can send money to other NequiDz users and anyone with a linked bank account. The app supports instant transfers between Nequidz users in Colombia and external bank accounts.

Can I use the NequiDz V2 APK for online shopping?

It offers virtual and physical MasterCard cards to shop securely online or in physical stores. The virtual card can be used immediately for online purchases, while the physical card is issued for physical transactions.

Advantages and Disadvantages of NequiDz V2 APK New Version:

Advantage:

- No monthly maintenance fees.

- Setting up your account is quick and easy.

- A wide range of services can be found in a single application.

- Real-time spending information and notifications.

- High security with biometric access.

Disadvantages:

- Only available in Colombia.

- All features require an internet connection.

- Some features (such as borrowing) are based on user authentication.

- Restrictions on customer service hours.

ADDITIONAL INFORMATION about NequiDz V2 APK’s latest version.

Requires Android -5.0 and Up

Target: Android 9.0

File Size- 6.9 MB

Current Version: v1.0

Rating – 4.6+

Price – Free

Conclusion

NequiDz V2 APK Laest version is a unique app with a clear goal: to allow users to simulate financial transactions through custom receipts. While it should be used responsibly and ethically, it benefits developers, educators, and freelancers. Its simple design, excellent performance, and focused features give it an outstanding performance that official apps often lack in flexibility. As always, users should exercise caution when using third-party apps and ensure they use them within legal and ethical limits.