InstaMoney APK

By: LenDenClub – Innofin Solutions Pvt. Ltd.

Rating: 4.7+ Downloads: 320+ Size: 76.3 MB Updated: September 21, 2023.

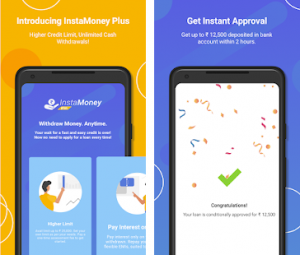

InstaMoney Apk is a leading instant personal loan app used by over 3 million users in India.

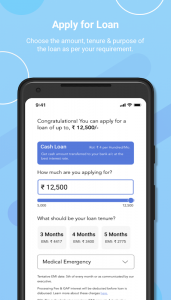

- Credit limit: ₹5,000 to ₹25,000

- Duration: 3 months to 5 months (91 days to 150 days)

- Interest Rate Margin (APR): 24% to 35.88% per annum

Example: Loan amount (principal) is ₹10,000 with a term of 5 months. The interest rate is 24% per year. Interest = ₹10,000 x 24% x 5/12 = ₹1,000 and the total balance in 5 months is ₹11,000 or ₹2,200 for EMI. (same monthly payments). Handling Fee (+ GST) = ₹500 + ₹90. Evaluation fee = ₹199, Get an instant personal loan from ₹5,000 to ₹25,000 in the app and transfer the money to your bank account within 2 hours.

Note: No credit history* required, no upfront fees, and low interest rates! All employees with a salary of ₹12,000 and above can get an instant cash advance with the InstaMoney App! Borrowers of instant loans and first-time borrowers of personal loans can also apply!

Download more similar Apk from our site Apkfreeload.com.

What is InstaMoney Apk?

Introducing InstaMoney Apk, A comprehensive fintech platform built to enable seamless Aadhaar Enabled Payment System (AEPS) transactions, point-of-sale (POS) transactions, top-ups and bill payments, and more.

An advanced onboarding portal allows agents and resellers to quickly register to become part of the broader digitization movement of India. Also, customers can enjoy services such as cash withdrawal, balance inquiry, mini-statement and yoga, home loans, and mortgages through Aadhaar-based transactions.

The user-centric design furthers the mission to make it easier for small business owners to move away from traditional banking processes. InstaMoney offers instant commission on every transaction, making it more profitable for agents and resellers.

Features of InstaMoney Apk

- You can get an instant loan without proof of income from the comfort of your own home

- Credit can be taken with no deposit, no deposit, no paycheck

- No credit history is required to get a loan from the Instamoney app. All you need is a CIBIL score in the selected city to get a loan from this loan app.

- Here you can get Rs as per your eligibility. 5,000 to Rs. Loans up to 25,000 are available.

- The repayment period varies between 3 months and 6 months

- With the help of this loan app, loans can be availed in more than 50 cities in India

- The Reserve Bank approved the loan application

- You can get an instant loan in just 5 minutes on Urgent Phone

- A loan can be taken out without documents

- No deposit is required before the loan

- Repaying loans on time increases your CIBIL

- This loan app has been downloaded over 1 million times so far and has a 4.3 rating on the Play Store!

Friends, here you get a loan without proof of income but remember you take a loan by installing a loan app on your phone and then also giving many permissions to access data in your Smartphone It can be viewed or used when needed!

Additional Features of InstaMoney Apk

- Instant loans up to ₹25,000

- Flexible repayment period from 91 days to 150 days

- No documentation

- Transfer money to your bank account in minutes

- No upfront payments, you only pay interest on the amount used

- Payday loan advance 24% – 35.88% per year equals 2% – 2.99% per month

- Minimum processing fee between 0% and 5% of the amount wagered

- Get higher loan amounts and other products with timely repayment

Why choose InstaMoney Apk?

One of the best multi-top-up companies in India, this portal offers multiple services under one platform and supports all customers.

Many services with one platform

Our multi-service platform is a high-density, flexible media processing platform with built-in signaling capabilities designed to enable developers to bring new services to market quickly and cost-effectively.

Help room

We offer the best support services in India. Customer service and support departments interact with customers when they need help. Learn the difference between service and support and see how they work.

The team

Our team is available to all our customers. We value all of our customers and strive to ensure our products work well. and provides technical support and targeted and specialized services to all its customers.

E-commerce

Looking for a Quality E-commerce Development Company? Get custom e-commerce development services and robust web design solutions at competitive prices. Our dedicated web developers are known for providing the best service!

Why is InstaMoney Apk different from other instant personal loan apps?

- More than 3 million users in India

- A loan amount of over £25 billion (2,500 crores) has already been disbursed

- The largest number of personal loans on a P2P lending platform in India.

- Get instant cash loans for various reasons like medical emergencies, credit card payments, tuition, salary advances, etc.

- The sanctioned loan amount can be used to shop online at Amazon, Flipkart, and BigBasket or book your tickets at Yatra, MakeMyTrip.

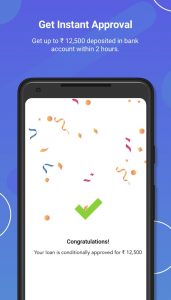

- Loan withdrawal time is 10 minutes to 2 hours

- Apply for a personal loan through the app and pay through the app

Eligibility Criteria:

- Employees

- Indian citizen

- Between 21 and 45 years old

- Minimum net salary ₹12,000 per month

- The full salary should be paid into the bank account

Only 4 documents are required:

- Selfie

- Overview map

- Proof of Aadhaar Card/Address ID

- Bank account balance

How does InstaMoney Apk work?

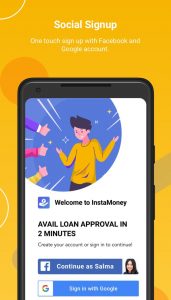

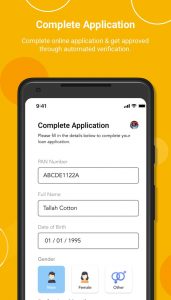

Follow the steps below to get the fastest personal loan in India:

- log in to InstaMoney Apk, verify eligibility, and pay the assessment fee for verification.

- Upload the required information and documents immediately.

- You will be informed of the approval status within 10 minutes of your personal loan application. Sometimes it even happens in real-time!

- After the personal loan is approved, the loan amount will be transferred to your bank account within 30 minutes.

Pan India Operation: All 28 States and 8 Union Territories.

Example of an instant loan:

A customer who takes out a personal loan of ₹10,000 at an interest rate of 24% per annum, where the processing fee is ₹500 for a period of 5 months, will have to repay ₹11,000 in 5 months. His monthly EMI will be £2,200.

Security and privacy:

InstaMoney App follows global standards for high-level data encryption/decryption protocols to protect user data.

InstaMoney Apk permission:

- Your age should be at least 21 years and at most 55 years

- Must have a monthly income source

- Credit history is only required for New Delhi, Uttar Pradesh, Bihar, Orissa, Jharkhand, Chhattisgarh, and West Bengal.

- It is necessary to link the mobile number to the Aadhaar

- Internet banking is also required in addition to a bank account.

- Income should be at least 12,000 per month and should show on your bank statement

- Loans can be availed in 50+ pop-up cities of India through this loan app

How do I take a loan from InstaMoney Apk?

- Install the InstaMoney Apk on your phone from the Google Play Store

- Sign up with your mobile number

- Include basic personal and professional information

- Upload the KYC document

- You will receive a loan offer in no time

- You can transfer this loan to your account with an electronic signature

Friends note that here you have to pay a Rs 199 credit assessment fee so check your eligibility first and if you think you are eligible then you are totally free to spend the money,

Here I am not promoting this loan application, Aadharseloan.Com takes no responsibility for it, you can accept this loan as per your understanding!

Conclusion.

This website (Apkfreeload) has some popular games and apps. We like to analyze and share the best games and apps on this website. If you are ready to use it, download the latest version of the InstaMoney Apk for your Android phone.

Please note that we only share the basic and free Apk versions without any modifications.

ADDITIONAL INFORMATION about InstaMoney Apk latest version.

Requires Android -5.0 and Up

Target: Android 9.0

Current Version: v5.2.9

Package Name: com.innofinsolutions.instamoney

Rating – 4.5+

Price – Free