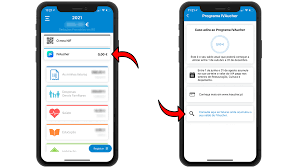

Ivaucher APP

By: SaltPay Portugal

Rating: 4.2+ Downloads: 17,000+ Size: 1.6 MB Updated: JUNE 02, 2021.

Ivaucher APP is an Android application developed by SaltPay Portugal. and offered for Android users. Ivaucher APP program is an incentive system sponsored by the Portuguese government that enables taxpayers to deposit VAT paid in the housing, cultural, and restaurant sectors. The amount covered can be deducted from future purchases of 50% of the three areas covered.

Pagaqui and Borgun, the Icelandic credit institution Borgun HF, which belongs to the international payment company Saltpay, to which Pagaqui belongs, has to provide the service of “querying the details of the movements of the profit current account and the balance.

What is Ivaucher APP?

Ivaucher APP is a government program of a temporary nature that was started to promote consumption in the areas most affected by the epidemic. It enables consumers to collect VAT paid in the catering, housing, and cultural sectors and later use them as profits in these sectors.

There are 3 different phases of the program:

- Accumulation Phase: Between 1st June and 31st August, consumers can levy VAT on purchases in the fields of gastronomy, housing, and culture. Just request an invoice with your TIN.

- Calculation phase: During September, the amount of accumulated profits is checked and calculated definitively;

- Use Phase: From 1st October to 31st December, customers can use the accumulated and calculated profits in each area with 3 covers up to 50% per purchase.

When can VAT be earned? What about discounts?

IVAucher has three different phases:

- In the first phase, between 1st June to 31st August, customers can deposit VAT for purchases in the three specified regions. Just request an invoice with your Tax Identification Number (NIF).

- In the second phase, during September, the amount of accumulated profit is examined and calculated.

- In the third phase, between October 1st and December 31st, customers can purchase accumulated and calculated benefits in each of the three areas covered, up to a limit of 50% per purchase.

Taxpayers only need to ask for currency

The credit should mention the invoice to which the taxpayers attach their TIN. In this way, taxpayers can deposit full VAT on consumption at establishments whose main CAE (Code of Economic Activity) is gastronomy, housing or culture.

Can groceries be spent on VAT books?

It is up to the consumer to decide where to use the consumer VAT, as IvyThere rules do not prevent the use of credit for meals or hotel stays in any way in the last quarter of the year. For example cinema, theater or music festival or buy books.

How is the discount used?

The use of consumer benefits (Ivaucher CREDIT) depends on the type of subscription of the retailer and whether it has TPA / POS from Pegakavi, Viva VetLet, or other participating operators or registered on the Ivaucher portal. And/or update accounting software with Internet access.

In the case of TPAs, to enable universal subscriptions, subscribers can access and withdraw credit access with their bank card by paying at PegQui or VivaVetLet or at other operator terminals with the Program Application Programming Interface (API).

In the absence of this and when the retailer registers on the IVAucher portal or updates the billing software, payment is made by simply transmitting the NIF and the relevant price confirmation by the customer is made in the IVAucher application.

Upon completion of this step (confirmation of payment of notification by mobile phone), 50% of the amount of invoice paid by the consumer will be debited from his account and 50% from his Ivaucher APP account. – If the current amount allows covering half of the cost.

Do I have to pay cash to earn VAT?

This program enables credit deposits regardless of whether the purchase was made by card or in cash. Credit discounts, on the other hand, mean that purchases are made with a bank card.

In which areas can I enter VAT value?

The program is tailored specifically to the areas of gastronomy, housing and culture (see list of eligible economic sectors). The VAT value of all payments in the above areas is converted into a profit which can be used later in one of these 3 areas.

When can I start drawing benefits and for how long?

The winning phase begins on June 1st and ends on August 31st. All customers requesting a TIN Invoice from an establishment in the areas covered during this period can view the automatically calculated Vetuture Balance.

Requires Android -5.0 and Up

Target: Android 9.0

Current Version:v1.0.3

Package Name:com.noticiasaominuto.pt

Rating – 4+

Price – Free